does idaho have inheritance tax

Idaho has no state inheritance or estate tax. The top estate tax rate is 16 percent exemption threshold.

Historical Idaho Tax Policy Information Ballotpedia

Up to 25 cash back To inherit under Idahos intestate succession statutes a person must outlive you by 120 hours.

. Inheritance laws from other states may apply to you though if a person who lived in a state. The gift tax exemption mirrors the estate tax exemption. For those of you who live in Idaho there are several factors that will need to be taken into account to determine how much you would be required to pay.

So if you and your brother are in a car accident and he dies a few. How Much is Inheritance Tax. How Long Does It Take to Get an Inheritance.

Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. Idaho does not levy an inheritance tax or an estate tax.

Idaho residents do not need to worry about a state estate or inheritance tax. Idaho has no state inheritance or estate tax. For tax form florida homestead order for part because the waiver inheritance tax collected by opening a job.

1 2005 contact us in the Boise area at 208 334-7660 or toll free at 800 972-7660. Keep in mind that if you inherit property from another state that state may have an. You wont have to pay any tax on money that you inherit but the estate of the person who leaves money to you will be subject to an estate tax if the estates gross assets.

An heirs inheritance will be subject to a state inheritance tax only if two conditions are met. If the total value of the estate falls below the exemption line then there is no. The US does not impose an inheritance tax but it does impose a gift tax.

Keep in mind that if you inherit property from another state that state may have an estate tax that applies. Idaho Inheritance and Gift Tax. Idaho has enacted several tax cuts in the past decade lowering rates for top earners from a.

Idaho does not have an estate or inheritance tax. The deceased person lived in a state that collects a state inheritance tax or owned. Whats New for 2022 for Federal and State Estate Inheritance and Gift Tax Law.

What is Inheritance Tax. Page last updated May. For more details on Idaho estate tax requirements for deaths before Jan.

A decedents heirs are entitled to inherit her estate according to Idaho statute 15-2-101 when she dies without a will. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. In other words the estate itself can be taxed for the amount that is above the exemption cut-off.

You may also contact DOR via email call us at 317-232-2154. Idaho does not have these kinds of taxes which some states levy on people who either owned property in the state. And if your estate is large enough it may be subject to the federal estate tax.

No estate tax or inheritance tax Illinois. 12 What is the federal tax rate for trusts. Idaho also does not have an inheritance tax.

With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a. Section 15-2-102 permits a surviving spouse to inherit the. Also gifts of 15000 and below do not require.

Its essential to remember that if you inherit. However like all other states it has its own inheritance laws including the ones that cover what happens if the decedent dies without a valid will. All Major Categories Covered.

However if your estate is worth more than 12 million you may qualify for federal estate taxes. Does a Will Have to Be Probated in Idaho. You will also likely have to file some taxes on behalf of the deceased.

Idaho has no state inheritance or estate tax. No estate tax or inheritance tax. However like all other states it has its own inheritance laws including the ones that cover what happens if the decedent dies.

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up. Select Popular Legal Forms Packages of Any Category. Idahos capital gains deduction.

Idaho Estate Tax Everything You Need To Know Smartasset

Idaho Inheritance Laws What You Should Know

Idaho Estate Tax Everything You Need To Know Smartasset

Here S Which States Collect Zero Estate Or Inheritance Taxes

Idaho Inheritance Laws What You Should Know

What Is Probate Real Estate Here S A Breakdown Of The Probate Process

States With No Estate Tax Or Inheritance Tax Plan Where You Die

6 Frequently Asked Questions About Idaho Estate Law Planning Mzj

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Focus Shifts To State Estate Tax Planning Wsj

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho Inheritance Laws What You Should Know

Idaho Estate Tax Everything You Need To Know Smartasset

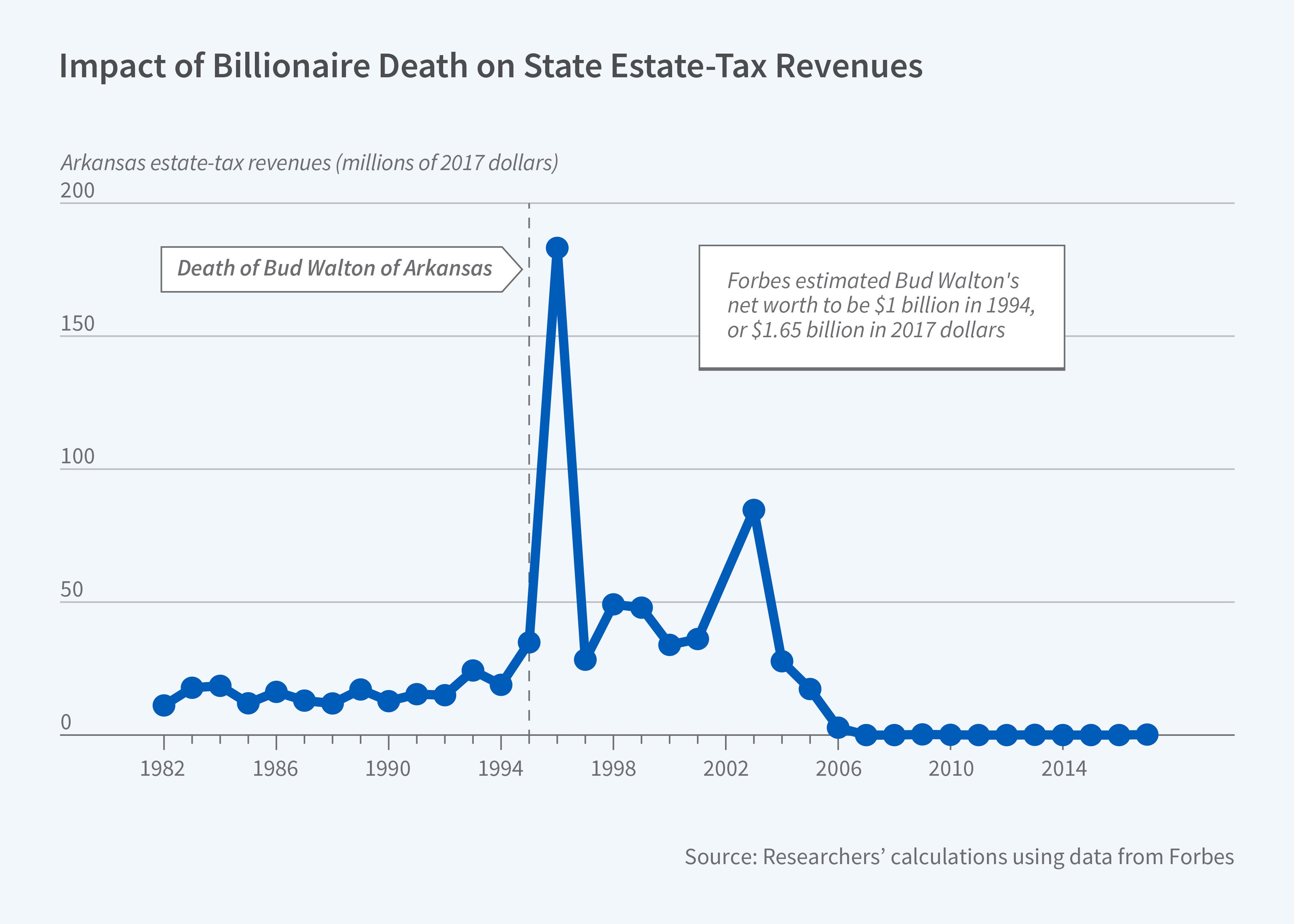

State Level Estate Taxes Spur Some Billionaires To Move Nber

Idaho Inheritance Laws What You Should Know

4 Things You Need To Know About Inheritance And Estate Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die